Iso exercise amt calculator

We calculate the tentative minimum tax by applying the AMT rate either 26 or 28 depending on the amount to the AMT base. You just saved yourself 19000.

You Should Probably Exercise Your Isos In December Graystone Advisor

Calculate my AMT Reduce my AMT - ISO Planner Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022.

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

. This will help you determine your actual AMT liability. The Federal AMT rate is 26 for incomes below 199900 28 if income is above the threshold. On this page is an Incentive Stock Options or ISO calculator.

A quick and dirty calculator to esimate your Alternative Minimum Tax AMT burden of exercising Incentive Stock Options ISOs. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your. A quick and dirty calculator to esimate your Alternative Minimum Tax AMT burden of exercising Incentive Stock Options ISOs.

By using the calculator you can estimate the AMT amount owed by exercising your stock options. As of the Tax Cuts and Jobs Act of. The income in the calculation includes ISO exercise gain minus the AMT exemption amount.

The AMT paid on an ISO exercise is designed to be a prepayment of taxes that gets recovered in the future but there are things to consider when triggering AMT with an ISO. If your ISO exercise. For 2022 the threshold where the 26 percent AMT tax.

This results in an AMT adjustment of 40000 40 spread x 1000 options that is part of your AMTI on Line 2i of Form. As of the Tax Cuts and Jobs Act of. People who had exercised ISOs in the past could calculate their potential refundable AMT credit by using the 1040 Form.

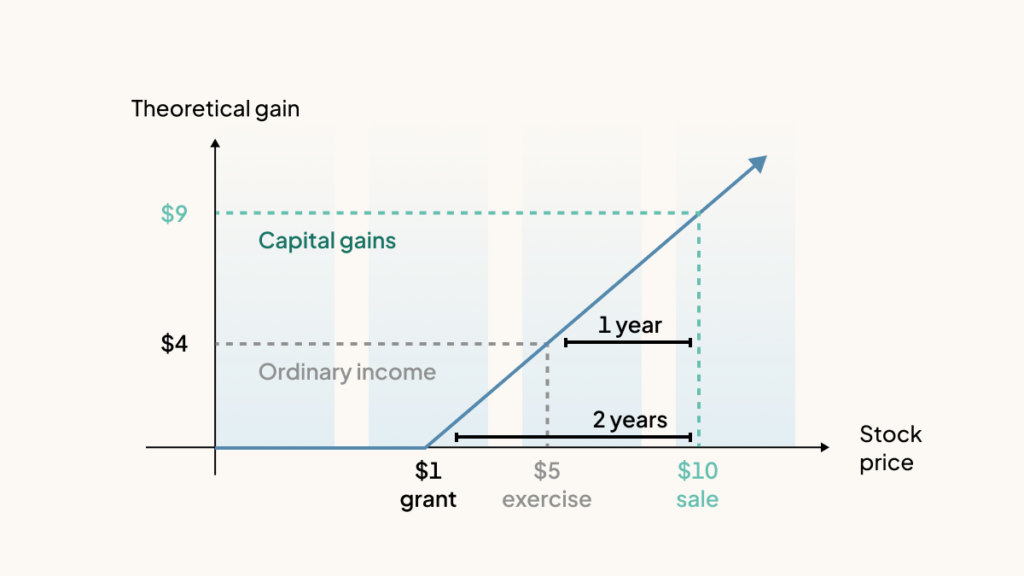

When it comes to calculating your Cost Basis with shares purchased via ISO options its based on what you paid regardless of what the market value was at the time of. Number of ISO to Exercise 75000 1465 Number of ISO to Exercise 5119 In this case you could exercise 5119 of your ISO shares before you had to pay the AMT. Apr 03 2019 When it comes to calculating your Cost Basis with shares purchased via ISO options its based on what you paid regardless of what the market value was at the time of.

Calculate my AMT Reduce my AMT - ISO Planner. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. You then hold the ISO stock through the calendar year of exercise.

Exercise profit 0 10 - 10 x 10000 options As a consequence your AMTI would be only 77100 so you would owe federal taxes that year. The alternative minimum tax AMT is a different way of calculating your tax obligation. Its designed to make sure everyone especially high earners pays an.

The AMT is charged when you exercise your ISO.

How Stock Options Are Taxed Carta

Secfi Alternative Minimum Tax Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Secfi Can You Avoid Amt On Iso Stock Options

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

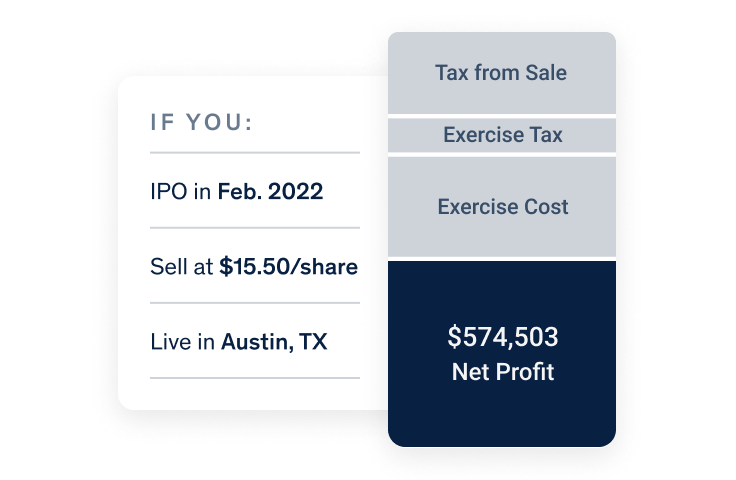

How To Use The Exercise Simulator In Your Carta Portfolio

Incentive Stock Options The Good The Bad And The Ugly

How Incentive Stock Options Can Trigger Amt Kinetix Financial Planning

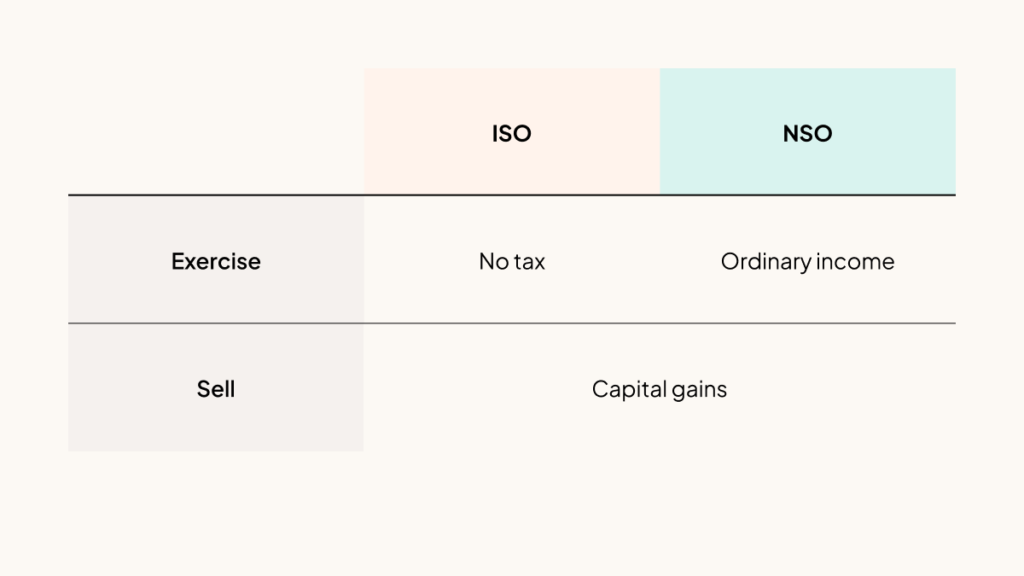

How Stock Options Are Taxed Carta

How To Avoid Amt On Iso Exercise With Lower Share Prices

Stock Options 101 When And How To Exercise And Sell Part 1 Of 2

How To Use The Exercise Simulator In Your Carta Portfolio

What Is Alternative Minimum Tax Amt

Reduce Amt Exercising Nsos

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Get Complete Assistance To Exercise Option Before They Expire Exercise Stock Options Helping People

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options